The State of the Watch Industry

Since mid-2019, the watch industry has gone through a massive shake-up. What has the unrest in Hong Kong and the COVID-19 pandemic done to the industry as a whole, and where does that leave the brands, trade shows and consumers?

JOHN NICHOLS

APRIL 24, 2020

The watch industry is in a vastly different place now than it was this time last year. From January to May 2019, Swiss watch exports hit all expectations, and all signs pointed towards 2019 being rounded off with the industry seeing a steady level of growth. Nobody could have predicted the events which have impacted watchmaking since, and which have brought us to the unsteady situation we see before us today.

Hong Kong Crisis

In June 2019, a series of major protests against the introduction of the Fugitive Offenders amendment bill by the Hong Kong government rocked the region. Exports of Swiss watches dropped by almost 27% in Hong Kong and almost 44% in China in a single month, and as the largest and third-largest markets for Swiss watch exports at the time, the sharp and immediate drop in sales hit the industry hard. Despite a quick bounceback in the Hong Kong market the next month, overall exports in 2019 would see an almost 12% drop for the Hong Kong market, and a less-than-predicted 16% increase in the Chinese market,

Analysis at the time was that even though the situation in Hong Kong had a major impact on these markets, the other world markets would rally to claw back the majority of the expected level of industry growth for the year – indeed, global Swiss watch exports rose by 2.3% compared to 2018. All signs pointed to 2020 being a year where the industry as a whole could rally, and brands were hastily preparing for the upcoming major trade shows.

COVID-19 Pandemic

Then came January 2020, and COVID-19 began its spread worldwide. The Chinese market, with the city of Wuhan being the epicentre of the outbreak, collapsed in February, recording a 55% drop in Swiss watch exports in a single month. Other markets worldwide almost unilaterally saw decreased exports, albeit in much smaller percentages.

As the health crisis got worse by the day, it was only a matter of time before the big two trade shows were affected. On February 27th, Watches & Wonders (formerly known as SIHH) announced the cancellation of its 2020 salon, and the very next day, following news from the Swiss government that gatherings over 1,000 people were banned, Baselworld postponed until January 2021 – the first time it would not hold its annual fair in its 102-year history. This would only signal the beginning of a very difficult time for all of us, as roughly a third of the world population being put under lockdown, with AD’s and retailers alike temporarily closing worldwide.

Export figures for March 2020 are yet to be published, but as Rolex, Patek Philippe, Audemars Piguet and a host of other manufacturers halted production throughout March, it is widely understood that these figures will see a sharp decline. Forget a decline in projected growth – this is a much bigger, and much more serious, situation for the industry as a whole. RJ Watches (formerly Romain Jerome) filed for bankruptcy in late February, and it is likely that several more heralded names in Swiss watchmaking will not make it through the other side.

What does this mean for Baselworld / Watches & Wonders?

Arguably, Baselworld hit its peak in 2014, with almost 1,500 exhibitors hosting 150,000 attendees over 8 days. In 2019, this had fallen to just 520 exhibitors and 81,200 attendees over 6 days. The annual show has seen a mass exodus of major brands in recent years, with the Swatch Group (including Breguet, Omega, Hamilton and many more) being one of the biggest casualties, attending for the last time in 2018.

With Baselworld postponing their 2020 event until January 2021, Rolex, Tudor and Patek Philippe announced that they would be postponing their 2020 launches until an unspecified later date. Rumours also began to swirl that Rolex executive Hubert du Plessix had written to Baselworld management requesting refunds for 2020 attendees, one of the main factors being that the proposed January 2021 date flew in the face of the agreement between Baselworld and Watches & Wonders to run their shows back-to-back between 2020 and 2024.

Then, the shock news arrived that Rolex, Tudor, Patek Philippe, Chanel and Chopard would be leaving Baselworld to run their own event in conjunction with FHH, the organisers of Watches & Wonders, in April 2021. Rolex CEO Jean-Frederic Dufour and Patek Philippe President Thierry Stern both pointed towards the mismanagement of Baselworld by the MCH Group, a lack of synergy between the consumer-focused direction of the shows and the brands, and a lack of consultation to the brands regarding the postponement.

Meanwhile, the haute horologie-focused Watches & Wonders has seen increased success in recent years. In 2015, the then-titled SIHH had only 16 exhibitors and 12,500 invited guests, which had increased to 35 exhibitors and 20,000 guests in 2019. Watches & Wonders strikes a chord with the brands looking to both promote, and find customers for, some of the finest watchmaking available in the world. Brands such as Ferdinand Berthoud, MB&F and H. Moser & Cie use Watches & Wonders as a platform to launch six-figure watches in a partnership which has seen many of these brands achieve growing success in recent years.

Despite cancellation of the physical event in Geneva, Watches & Wonders have decided to run the event as a digital experience, starting 25th April, where brands can promote their new releases, or just present their watchmaking ability to the public. An experience such as this would have been nigh-on impossible to do for a trade show as large as Baselworld, but it suits the smaller size of Watches & Wonders fantastically well, whilst briging a touch of the prestige and exclusivity of the event to the general public.

Baselworld, and to a lesser extent Watches & Wonders, have received critique in the last few years that they are out of touch, both with the brands, and with the consumers. The mismanagement of Baselworld in recent years has certainly contributed to its decline, but I would vow against lumping Watches & Wonders into the same category. Watches & Wonders as a physical event works brilliantly for the limited clientele it is aiming for, and with its move to host the 2020 event online, it has proven far more willing to move with modern trends than its counterpart.

What other options are available to brands?

The decline of the big two trade shows has seen an increase in brands going it alone in various guises. LVMH, which includes maisons Bvlgari, Hublot, TAG Heuer and Zenith, held the first edition of their LVMH Watch Week in Dubai this January, and the event was seen as a huge commercial success. Bvlgari had already pulled out of Baselworld for 2020, but just a short time ago, the other LVMH maisons joined them, with speculation rampant that they will partner with Rolex and Patek Philippe’s new event in April 2021.

Seiko and Grand Seiko announced in November 2019 that they would not be taking part in Baselworld 2020. This was off the back of two successful events for Grand Seiko in the UK, and seems to be part of a bigger shift within Grand Seiko specifically, as they had announced plans to establish a new company to manage a new Grand Seiko boutique in Paris, before COVID-19 scuppered the March opening.

Grand Seiko had also planned an independent 60th anniversary summit, to take place in Tokyo in early March 2020, but the COVID-19 situation led to its cancellation in early February. The Swatch Group had also organised a press and retailer summit, entitled “Time to Move”, also to be held in early March in Zurich, which was also cancelled.

Whilst the majority of what would have been the first year of a plethora of independent events has been affected by the COVID-19 crisis, I don’t think this will force these brands to reconsider. Turning their backs to Baselworld is not a move that these brands made lightly, and once the worldwide situation begins to return to business as usual, I am sure each one of them will reorganise and run very successful events, as LVMH did.

How do you reach the customer in 2020?

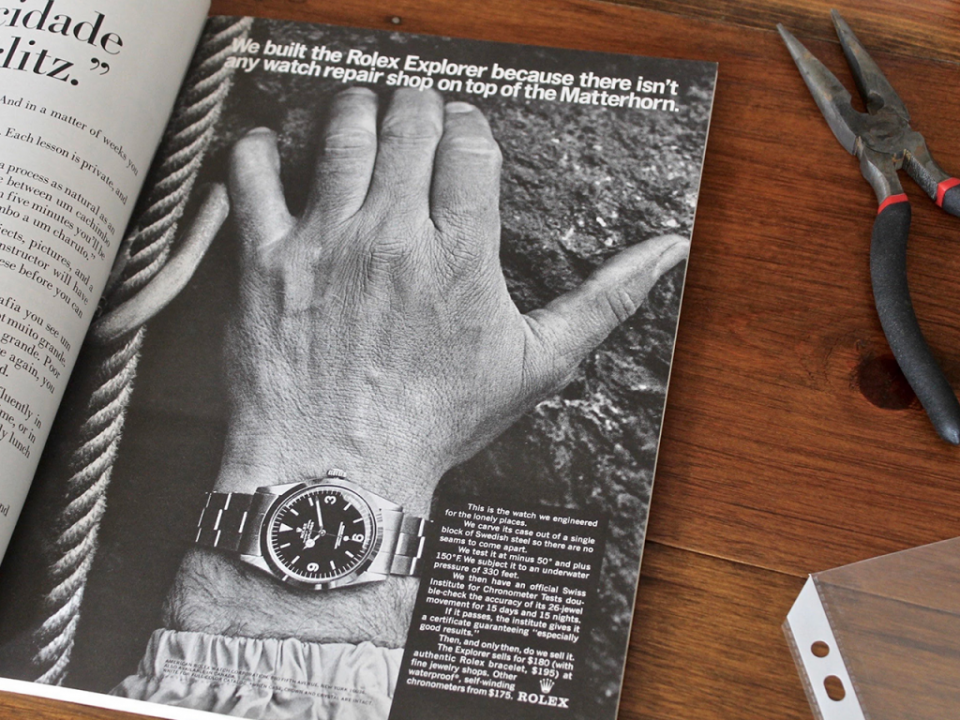

Many of the brands who have left Baselworld have done so for the same reasons; they are unimpressed with its management and direction, and they would like greater control over how to present themselves to the market. The watch industry finally seems as though it is looking to incorporate new media into its marketing strategies, and although the majority of the marketing budget for these brands goes on events and print media (working in print myself, these trends are certainly continuing), we are seeing more time, effort and money invested into other avenues.

One of the reasons that fashion watch brands such as Daniel Wellington, MVMT and Vincero have done so well is that they’ve invested heavily into online marketing to really convince (or dupe, depending on your point of view) potential customers that their watches are worth purchasing. Following their example, traditional watch brands have begun to use online influencer marketing to better interact with their audience – a move which, criticism not withstanding, I think is vital for them to find a new generation of customers.

YouTubers such as Brian Sacawa and Teddy Baldassarre have partnered with traditional watch brands to promote select pieces, and this is likely a trend we will only see increase in the coming years.

Direct-to-consumer e-commerce is often touted as a logical step for traditional brands to make. However, these have been dismissed in recent years by these brands, and if I were to look at things from their perspective, I can understand why. Many of these brands rely on their AD’s to make their customers feel special, and as such believe that buying a watch should be a warm, unique experience, not a cold interaction with a screen. E-commerce would also see brands compete directly with their own AD’s, which is a losing situation for both parties.

At the moment, e-commerce only accounts for less than 5% of all luxury watch sales, and with figures that low, many brands simply don’t see the investment in such a system to be worth the outcome. However, the rise of dedicated pre-owned luxury watch sites such as Watchfinder and Watchbox has led some brands to reconsider their approach.

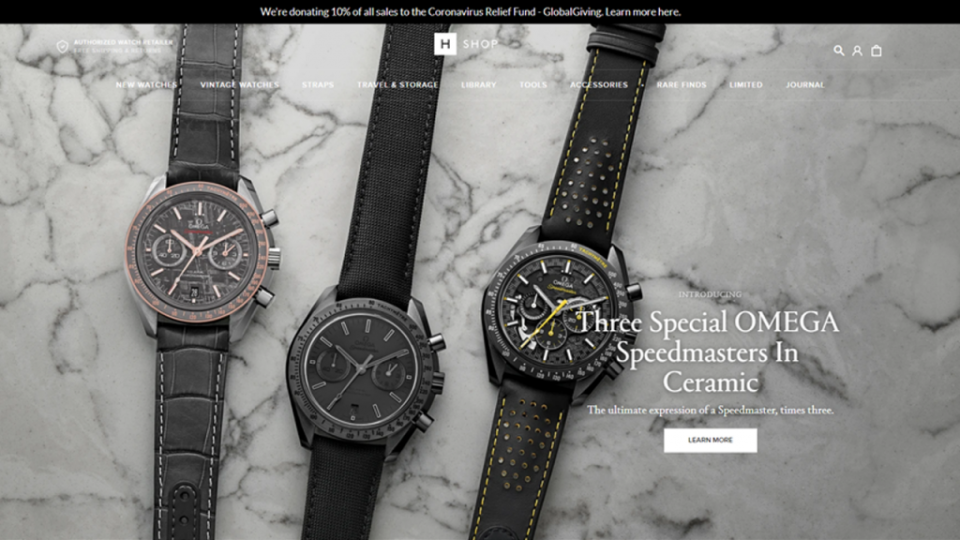

Vacheron Constantin, Omega and TAG Heuer are just three brands amongst many which have collaborated with HODINKEE to feature their watches in the HODINKEE Shop, bringing direct-to-consumer purchase options to their audience. HODINKEE acts as an AD for all of the brands which it stocks, and brands strike a chord with their high-end web service professionalism, and values.

Third-party partnerships are likely to be key to these traditional retailers in establishing a connection with a new generation of watch enthusiasts, which increasingly shun traditional media in favour of the new digital standard. High-end print and exclusive events are by no means dead, but the smart brand will diversify to ensure this new generation is catered for. AD’s will remain the premier way for luxury brands to distribute their timepieces for some time to come, and until there’s a major shift in consumer habits, the AD-focused model will remain king.

Where do we go from here?

The industry as a whole is hurting right now. Early predictions are that total Swiss watch exports will reduce by 25% in 2020 – slightly more than the 22% drop seen in 2009 due to the financial crisis. As with many industries, there is a light at the end of the tunnel anticipated. Pre-COVID-19, the industry was enjoying steady, sustainable growth, which many predict we will see a return to.

As for the trade shows, it’s a tale of two halves. Whereas Watches & Wonders (and FHH) looks like they will continue on strong following the cancellation of their 2020 salon, it is difficult to see where Baselworld will go from here. With almost all of the major brands having now left, it is looking like the show’s 102-year history is on the brink of coming to an end. Without the major brands paying their huge exhibitor fees, especially after a difficult Baselworld 2019 contributed to mounting financial difficulty for the MCH Group, I cannot see how the next iteration of Baselworld will be financially viable under its current guise.

Whether Baselworld survives or not, its remaining exhibitors now have a lot of choices to make regarding the future of their marketing. Will more decide to join Rolex and Patek Philippe’s new event? Will we see a rise of independent events, and increased digital integration? Only time will tell. We are in the midst of a shifting of the sands for the industry to rival that of the quartz crisis. This will not just impact the major brands, but the industry as a whole, and I hope traditional watchmaking can come out of the other side as a stronger, agile, more modernised beast, ready to take on the coming decade and beyond.

Published April 24, 2020.